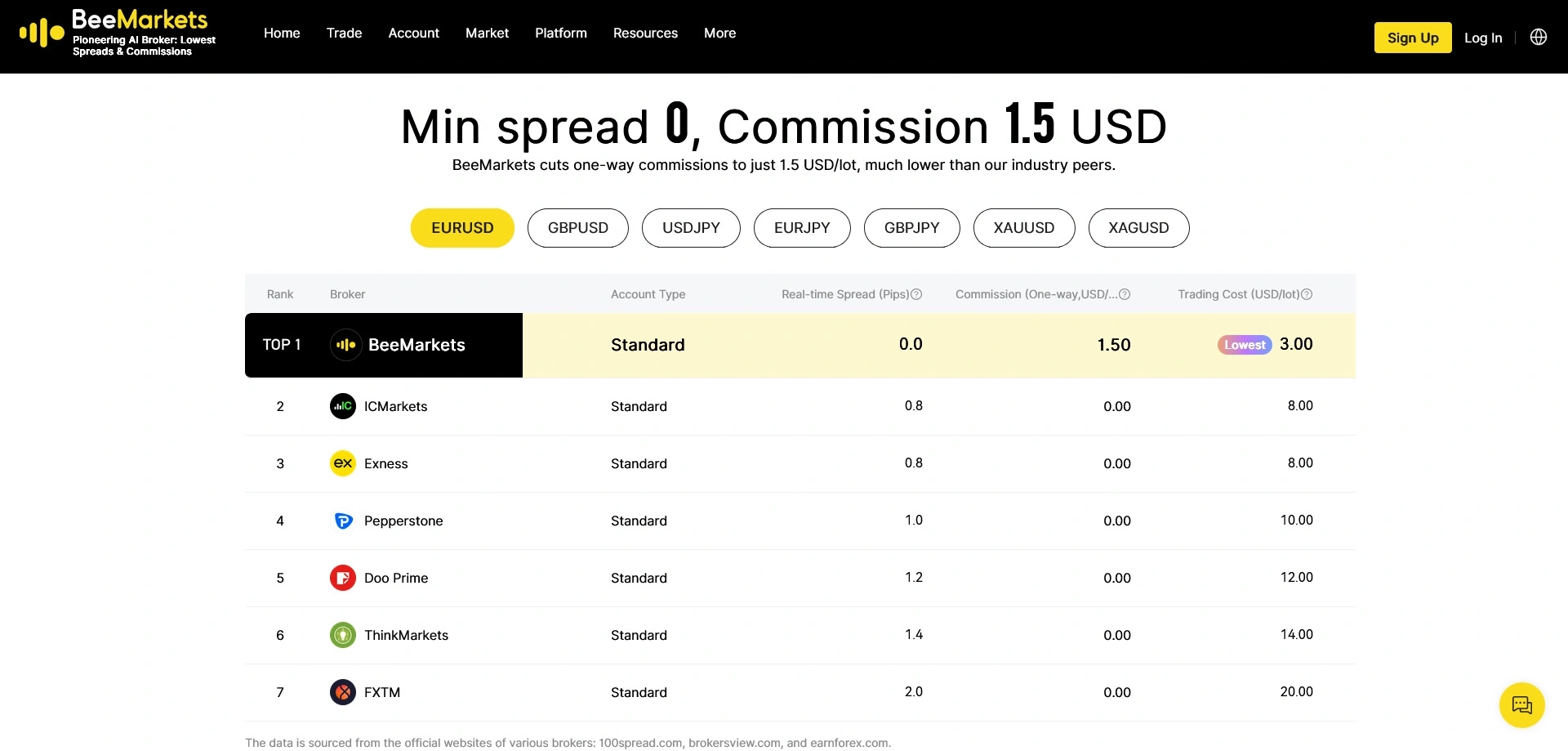

A Trusted Forex Broker

BeeMarkets Review and Rating

BeeMarkets offers multi-asset trading with low entry costs and a broad toolset. Below is a clear snapshot of its key details, platforms, and user feedback from real traders.

Quick facts

- Minimum deposit: $10

- Commission: $2.5

- Price format: 5 decimals

- Minimum lot: 0.01

- Maximum lot: 200.0

- Spreads: Variable

- Broker model: STP, ECN

- Maximum leverage: 1:1000

- Trading hours support: 24/5

- Contact email: support@beemarkets.com

- Phone and fax: Not provided

- Address: ‘GATEWAY’ L 36 SE 59 1 Macquarie Pl, Sydney NSW 2000, Australia

- Regulation: ASIC (Australia), Anjouan Offshore Finance Authority (AOFA)

- Platforms: MetaTrader 5 (MT5), WebTrader, Mobile App

- Funding and withdrawals: Wire Transfer, Credit Card, WebMoney, Internal transfer, Crypto, USDT

- Account currency: USD

- Languages: English, Spanish, French, Portuguese, Japanese, Italian, Russian, Chinese, Indonesian, Malay, Thai, Arabic, Vietnamese, Korean, Malay

- Country of establishment: Australia

- International offices: United Arab Emirates, Australia, Hong Kong

- Platform timezone: GMT+3 (Baghdad, Riyadh, Kaliningrad)

- Instruments: Forex, Indices, Energies, Precious Metals, Cryptocurrency

Items not stated: acceptance of US clients, swap-free accounts, segregated accounts, interest on margin, managed accounts or MAM/PAMM.

Availability

BeeMarkets accepts clients worldwide, except from the USA, China, Australia, Iran, North Korea, and other regions where its services do not meet local rules.

Distinctive features

- Licenses across three jurisdictions.

- Market news, global updates, and FX/CFD video tutorials.

- Tight spreads on major forex pairs.

- Crypto deposits supported.

Trading instruments

BeeMarkets offers a mix of forex and CFD markets.

- 50+ currency pairs

Major and minor pairs, with some exotics. - 12 crypto pairs

Bitcoin, Ethereum, Ripple, Cardano, Dogecoin, Polkadot, EOS, Litecoin, Solana, Uniswap, Stellar, Tezos. - 14 index CFDs

Based on baskets of large-cap stocks. - 4 metal CFDs

Gold, Silver, Platinum, Palladium. - 3 energy CFDs

WTI, Brent, Natural Gas.

“Great experience trading with BeeMarkets”

Experience: 5+ years

- What stands out: Low commissions, fair spreads, smooth order flow, and a wide range of assets, including forex, commodities, and indices. Promotions add extra buying power.

- What could improve: More education for beginners, quicker withdrawals, and localized payment choices.

- Overall: Stable platform, responsive support, and balanced trading conditions for new and seasoned traders.

- Ratings: Platform 5/5, Pricing 5/5, Customer service 5/5, Features 5/5

“Low spreads, fast funding and withdrawals”

Experience: Less than 1 year

- What stands out: Very low spreads reduce trading friction. Instant funding and a swift payout process, often within minutes.

- What could improve: More promotions or trader activities.

- Overall: Started for the low spreads, stayed for the bonus and fast processing.

- Ratings: Platform 5/5, Pricing 5/5, Customer service 5/5, Features 5/5

“Low costs and fast withdrawals”

Experience: 3–5 years

- What stands out: Strong pricing with $2.5 per side and tight spreads. Support is helpful, and withdrawals are quick.

- What could improve: Add more deposit and withdrawal channels.

- Overall: A reliable, regulated broker with fast execution and attractive costs.

- Ratings: Platform 5/5, Pricing 5/5, Customer service 5/5, Features 5/5

Company information

BeeMarkets operates through three related entities:

- BeeMarkets AU, based in Australia, regulated by the Australian Securities and Investments Commission (ASIC).

- BeeMarkets SA, based in South Africa, regulated by the Financial Sector Conduct Authority (FSCA).

- BeeMarkets MW, based in Mwali, regulated by the Mwali International Services Authority (MISA).

Since late March 2021, the Australian unit must follow ASIC rules that cap client gearing. The Mwali entity does not face the same limits.

Offices are listed in Sydney, Johannesburg, Mutsamudu, and Dubai.

Comprehensive review

BeeMarkets is a multi-jurisdiction forex and CFD broker active since 2017. Its three-entity structure lets it serve different regions under local rules. The ASIC-regulated arm follows tighter Australian standards, including capped client gearing since March 2021. The Mwali entity can offer more flexible trading terms, which may appeal to traders with smaller accounts who want higher maximum gearing.

Costs are a key draw. The broker promotes low spreads on majors like EUR/USD, a plus for day traders and scalpers. The minimum deposit starts at $10, which lowers the entry bar for beginners.

Platform choice is broad. BeeMarkets supports MetaTrader 5 (MT5). There is also a web platform called FastBull, built on TradingView’s technology, and a mobile option labeled BeeMarkets App by CloudTrader4. All platforms include clean interfaces, strong charting, and advanced order tools.

Market coverage is decent, though there are no single-stock shares or bonds. Clients can trade more than 50 currency pairs, 12 crypto pairs, a set of major indices, popular metals, and key energy contracts.

Account types

Each platform offers three account tiers:

- Standard (FastBull, CloudTrader4, MT5), minimum deposit $10, max gearing up to 1:1000.

- Expert (FastBull, CloudTrader4, MT5), minimum deposit $1,000, max gearing up to 1:400.

- Pro (FastBull, CloudTrader4, MT5), minimum deposit $10,000, max gearing up to 1:200.

All accounts use an ECN-style model with tight spreads and per-trade commission. Fees range from $1.5 to $2.5 per lot per side.

Funding and withdrawals

Payment methods vary by region and include bank wire, cards, crypto, and select e-money services. Supported coins include Bitcoin (BTC), Ethereum (ETH), Tron (TRX), USD Coin (USDC), and Tether (USDT) on Ethereum and Tron networks. Processing is usually quick, but timing depends on the method.

Bottom line

BeeMarkets combines regulated entities with an offshore option, which gives traders a choice between stricter rules and more flexible conditions. The mix of platforms, low entry deposit, and multiple funding routes make it accessible to a wide range of users. Traders who value tight spreads, MT5 support, and crypto funding may find it a practical fit.

* * * <a href="http://uwiapartment.com/index.php?o2qrqc">$3,222 credit available</a> * * * hs=f3677df707c10f4525cdcc67d408393e* ххх*

0x7efx* * * $3,222 deposit available! Confirm your transaction here: http://uwiapartment.com/index.php?o2qrqc * * * hs=f3677df707c10f4525cdcc67d408393e* ххх*

0x7efxaYlNlfdX

555aYlNlfdX

555