XM Broker Review What You Need to Know

XM is a well-known

global broker that’s popular with new and intermediate traders. It

offers a wide selection of learning resources, a large choice of

instruments, and responsive customer support. This review is based on

hands-on testing and feedback, aiming to give you a clear look at XM’s

trading conditions, features, support, regulatory coverage, and overall

experience.

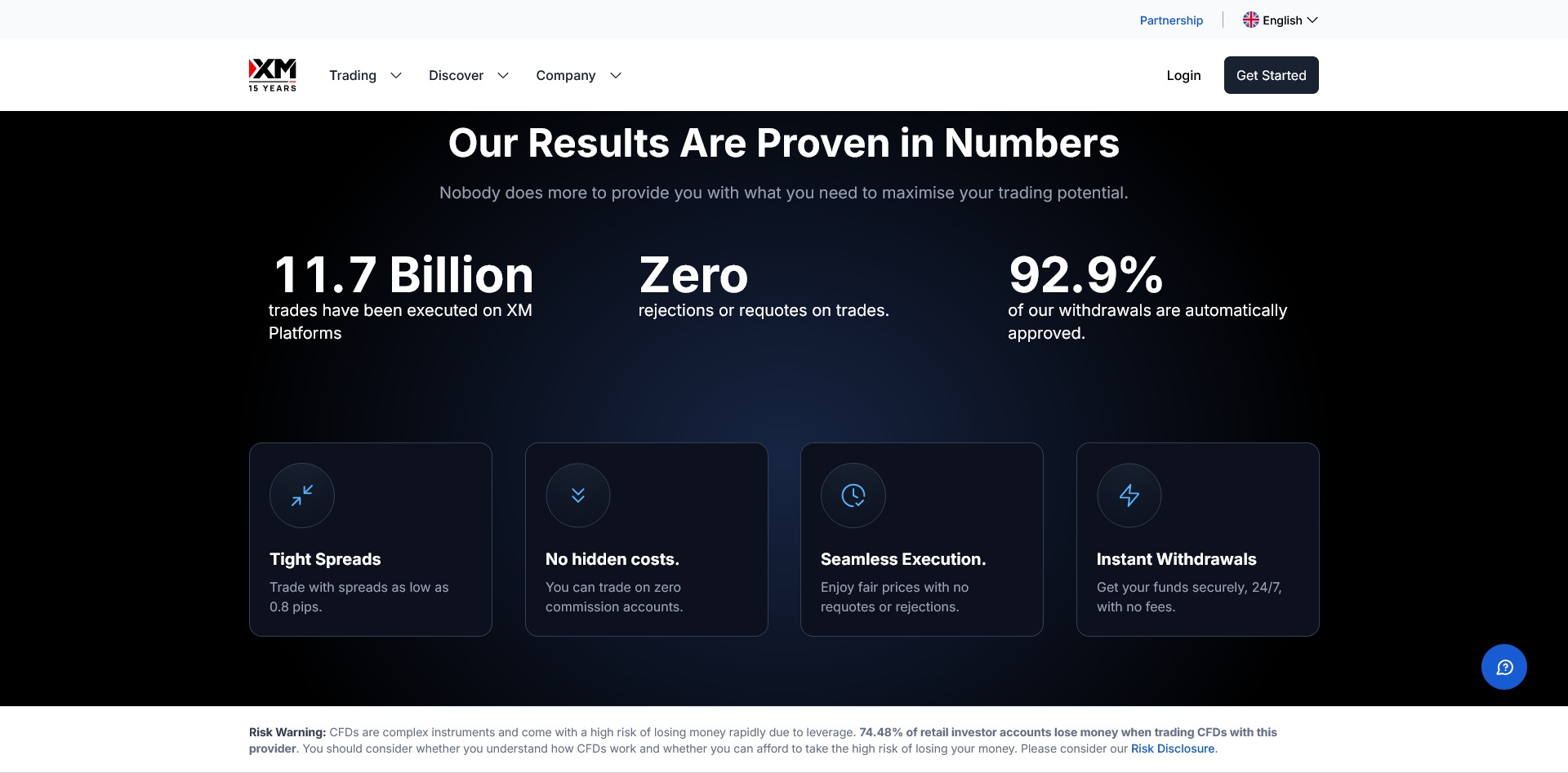

Quick Scores

- Account Conditions: 7.2

- Tools and Resources: 9.2

- Customer Support: 9.6

- Trading Settings: 8.4

- Trust: 7

- User Experience: 8.4

Overview of XM

Launched in 2009, XM is

a trusted broker for forex and CFDs, serving millions around the world.

Beginners and intermediate traders will find its MetaTrader 4 and 5

platforms familiar and easy to use. The platform gives access to over

1,200 trading instruments—forex pairs, stocks, commodities,

cryptocurrencies, indices, and more.

A standout feature of XM is

its focus on trader education. The broker offers free webinars, daily

analysis, and a host of training tools that suit all levels. These

resources are especially good for those who want to strengthen their

trading skills.

XM is licensed and regulated by top agencies such

as CySEC, FSCA, DFSA, and the FSC in Belize. This structure keeps the

company accountable to strict standards, though services and oversight

vary by region.

Where XM is Regulated

- Cyprus

- South Africa

- Dubai

- Belize

Currencies for Deposit/Withdrawal

XM

accepts major and regional currencies, such as USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR, and USDT. Some currencies depend on your

region.

Minimum Deposit

- Micro, Standard, Ultra Low, and Zero Accounts: $5 or equivalent

- Shares Accounts: $10,000 or equivalent

Promotions and Bonuses

XM

does not offer traditional bonuses in most regions due to local laws.

However, they do promote free VPS services and no fees for deposits or

withdrawals. XM Global offers promotions like trading bonuses, deposit

bonuses up to $5,000, cashback, loyalty points, competitions, and more.

These offers may change depending on your location and regulatory body.

Types of Available Instruments

XM gives access to:

- Forex

- Stock CFDs

- Turbo stocks

- Commodities

- Equity and currency indices

- Energies (cash and futures)

- Precious metals (spot and futures)

- Thematic indices

- Crypto CFDs

XM Global clients may also trade direct shares. Regional rules affect which assets you can use.

Costs: Spreads, Fees, and Commissions

XM offers several account types, each with its own fee setup:

Ultra Low Micro/Standard Accounts

- Forex Majors: from 0.8 pips

- Forex Minors: from 1.3 pips

- Forex Exotics: from 3 pips

- Precious Metals (Spot): from 1.7 pips

- No separate commission; fees are in the spread

Micro and Standard Accounts

- Forex Majors: from 1.6 pips

- Forex Minors: from 1.8 pips

- Forex Exotics: from 3.6 pips

- Precious Metals (Spot): from 2.7 pips

- No separate commission

XM Zero Account

- Spread: lower, but commission-based ($3.50 per side per 100,000 units)

- No commission for spot metals

Share Trading

- US shares: $0.04 per share (minimum $1)

- UK shares: 0.10% (minimum $9)

- German shares: 0.10% (minimum $5)

Stock

CFDs, indices, commodities, energies, and cryptos have variable spreads

and may include dividend adjustments or swap charges. Withdrawal fees

can apply for low transfer amounts.

Leverage

Leverage depends on regulation and asset:

- CySEC (EU): up to 30:1

- FSCA (South Africa), DFSA (UAE), FSC (Belize): up to 1000:1

Leverage for specific asset classes may be lower and depends on the account’s jurisdiction.

Platforms

- MetaTrader 4

- MetaTrader 5

- MetaTrader Web

- Mobile apps for iOS and Android

Restricted Regions

XM does not accept clients from the USA, Canada, Israel, or Iran.

Customer Service Languages

XM

offers support in up to 30 languages, including English, Greek,

Chinese, Malay, Russian, French, Spanish, Italian, German, Polish,

Hindi, Arabic, Portuguese, Czech, and more. Language availability may

vary by region and support channel.

XM Account Types

XM has several account choices based on region and trader needs:

- Micro Account: For new traders or those with small balances. Lower position sizes.

- Standard Account: For those trading larger amounts. Eligible for loyalty rewards.

- Ultra Low Account: Tighter spreads; best for those who want lower trading costs. Not eligible for loyalty rewards.

- Zero Account: Commission-based, with the lowest spreads. For experienced traders.

- Shares Account: Direct stock trading. $10,000 minimum deposit.

- Islamic Account: Swap-free, no admin fees, no commissions. Available on request after opening and verifying a regular account.

No Multi Account Manager (MAM) or PAMM accounts available.

XM Deposits and Withdrawals

Depositing

Payment options include credit/debit cards, Skrill, Neteller, wire

transfer, Perfect Money, Apple Pay, Google Wallet, and local methods.

Processing is fast—some deposits show instantly, though others may take

up to five business days.

Withdrawing

Withdrawal requests are usually processed within 24 hours.

- Bank and card withdrawals: 2–5 business days

- E-wallets: Often same or next day

- Minimum withdrawal: $5 for most accounts; $10,000 for Shares Account

XM

requires using the same payment method for withdrawal as for deposit,

following a set order. For example, withdrawals go back to your credit

card first, then to e-wallets or bank transfer if needed. This process

can cause delays, especially for larger withdrawals or if your

verification is incomplete. Some users report longer waits with bank

transfers or if additional checks are needed.

To avoid problems:

- Fully verify your account

- Use the same personal information for all payments

- Watch your margin

- Check withdrawal limits for your region

XM Trading Instruments and Settings

XM offers over 1,200 instruments including:

- 50+ currency pairs (majors, minors, exotics)

- Over 50 crypto CFDs (where allowed)

- More than 1,200 stock CFDs

- 100+ direct stocks (regional access)

- 12 turbo stocks

- 20+ indices

- 5+ commodity CFDs

- Futures CFDs on metals, energies, and more

No options, bonds, or ETFs.

Lot Sizes

Minimum and maximum lot sizes depend on account type and asset. For example:

- Ultra Low Micro: min 0.1, max 100 lots

- Ultra Low Standard and Zero: min 0.01, max 50 lots

- Shares: 1 share minimum

- Crypto CFDs: min 0.01 lot

Leverage

Varies by regulator and market—from 30:1 (EU) to up to 1000:1 (Belize, South Africa, UAE).

Execution Quality

XM acts as a market maker, matching most orders in-house. Spreads can

change with market conditions. Execution is generally fast, with both

positive and negative slippage possible. Most trades fill smoothly, but

fast-moving markets or exotic pairs may see wider spreads and more

slippage.

Tools and Resources

XM’s MT4 and MT5 platforms

provide a reliable, familiar trading environment with many features for

analysis and automation. XM WebTrader allows trading from a browser, and

mobile apps keep you connected on the go.

Other tools include:

- Daily technical analysis and market commentary

- Free webinars in over 20 languages

- Live trading education sessions

- Video tutorials and guides

- XM TV, podcasts, Reuters news feeds

- Economic calendar

- YouTube Shorts and technical stories

XM Global also offers copy trading in some regions.

Safety and Regulation

XM is regulated by several respected agencies:

- CySEC in Cyprus

- FSCA in South Africa

- DFSA in Dubai

- FSC in Belize (XM Global)

Clients

in the EU have investor protection up to €20,000 with CySEC. XM keeps

client money separate from company funds, adding another safety layer.

The platform does not accept clients from the USA, Canada, Israel, or

Iran.

Awards and Recognition

XM has won several awards

over the years, including five honors at the World Finance Forex Awards

2023, such as Best FX Customer Service and regional awards for Europe,

Australasia, Latin America, and the Middle East. These prizes reflect

good service and market presence, but always weigh them alongside your

own research and experience.

Customer Support

XM offers

support through live chat, WhatsApp, Line, Viber, Telegram, email, and

phone. Help is available 24 hours on weekdays and for 18 hours during

weekends. The support team responds quickly, often within a minute, and

provides clear and helpful answers. XM also has a well-stocked Help

Center.

Website and App Languages

XM’s website and platforms offer support in a wide range of languages, fitting clients from many countries.

User Reviews Snapshot

Traders

generally like XM’s fast deposits, quick withdrawals, and the variety

of trading tools available. Many users say the platform’s spreads are

fair and that customer service is helpful. Some clients highlight smooth

local bank transactions, especially in countries like India.

A

few users report delays with larger withdrawals or during busy trading

periods. Some criticize spreads on certain account types or find

withdrawal instructions confusing. Most negative reviews relate to

payment delays, but verification and following the correct withdrawal

methods typically clear up most issues.

Bottom Line

XM is a

strong choice for new and intermediate traders who want a reliable,

easy-to-use platform with a wide range of assets. You can start with

just $5, join in on educational events, and practice on demo accounts.

XM stands out for its customer service and tight regulation, which adds

an extra layer of trust.

On the downside, some users have

mentioned slow withdrawals or unclear bonus offers, and these issues

seem more common in certain countries. Make sure to verify your account

and check all payment steps to avoid setbacks.

If you want a

broker with flexible accounts, good resources, and a focus on client

support, XM is worth considering. Just stay aware of the regional

differences and review their terms to make sure they fit your trading

style.

Founded in 2009 and based in Cyprus, XM serves

clients across the world and is licensed by regulators like CySEC, ASIC,

FSCA, and DFSA. XM Global, registered in Belize, gives international

clients higher leverage options. The group serves over 10 million

traders and is known for strong support and a broad range of trading

products.

FAQs

Is XM regulated?

Yes.

XM holds licenses from leading authorities including CySEC (Cyprus),

FSCA (South Africa), DFSA (Dubai), and FSC (Belize for XM Global).

How does XM protect client funds?

Client money is kept in separate bank accounts, apart from company

funds. This helps safeguard your balance, even if the broker faces

financial trouble.

Where is XM headquartered?

XM’s main office is in Limassol, Cyprus, and XM Global operates out of Belize City.

What assets can I trade with XM?

You can trade more than 50 currency pairs, over 1,300 stock CFDs, 100+

traditional stocks, turbo stocks, indices, commodities, futures, and

cryptocurrencies (the latter only in allowed regions).

Does XM offer options, bonds, or ETFs?

No, these assets are not provided.

How do I open an XM trading account?

- Go to the XM website and click “Open an Account.”

- Register with your country, email, and password.

- Confirm your email.

- Complete your profile in the Members Area.

- Choose your platform, account currency, and type.

- Read and accept the terms, set leverage, and create a password.

- Upload verification documents (ID and proof of address).

- Wait for account approval (usually 24–48 hours).

- Fund your account and start trading.

XM

keeps registration simple and supports a broad set of clients

worldwide. Always check current requirements and the regional terms

before you start trading.